As an introduction to payment systems martin goodman takes center stage, this opening passage beckons readers with american pop culture language into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

If you’re looking to get your hands dirty with the latest in payment systems, Martin Goodman’s book is a must-read. But if you’re more interested in mapping out your next adventure, check out an introduction to geographical information systems 4th edition . It’s like a GPS for your brain, helping you navigate the complexities of spatial data and analysis.

And when you’re ready to dive back into the world of finance, Martin Goodman’s book will be waiting for you on the other side.

Payment systems are the backbone of modern economies, facilitating the seamless exchange of goods and services. From the humble beginnings of barter to the cutting-edge advancements of digital currencies, the evolution of payment systems has been intertwined with the progress of civilization itself.

An introduction to payment systems by Martin Goodman provides a comprehensive overview of the intricate world of financial transactions. However, for those seeking to delve deeper into the realm of education, an ideal education system offers a thought-provoking exploration of the principles and practices that shape the future of learning.

Yet, as we return to our discussion of payment systems, Goodman’s insights remain invaluable for understanding the mechanisms that underpin our financial ecosystem.

An Introduction to Payment Systems

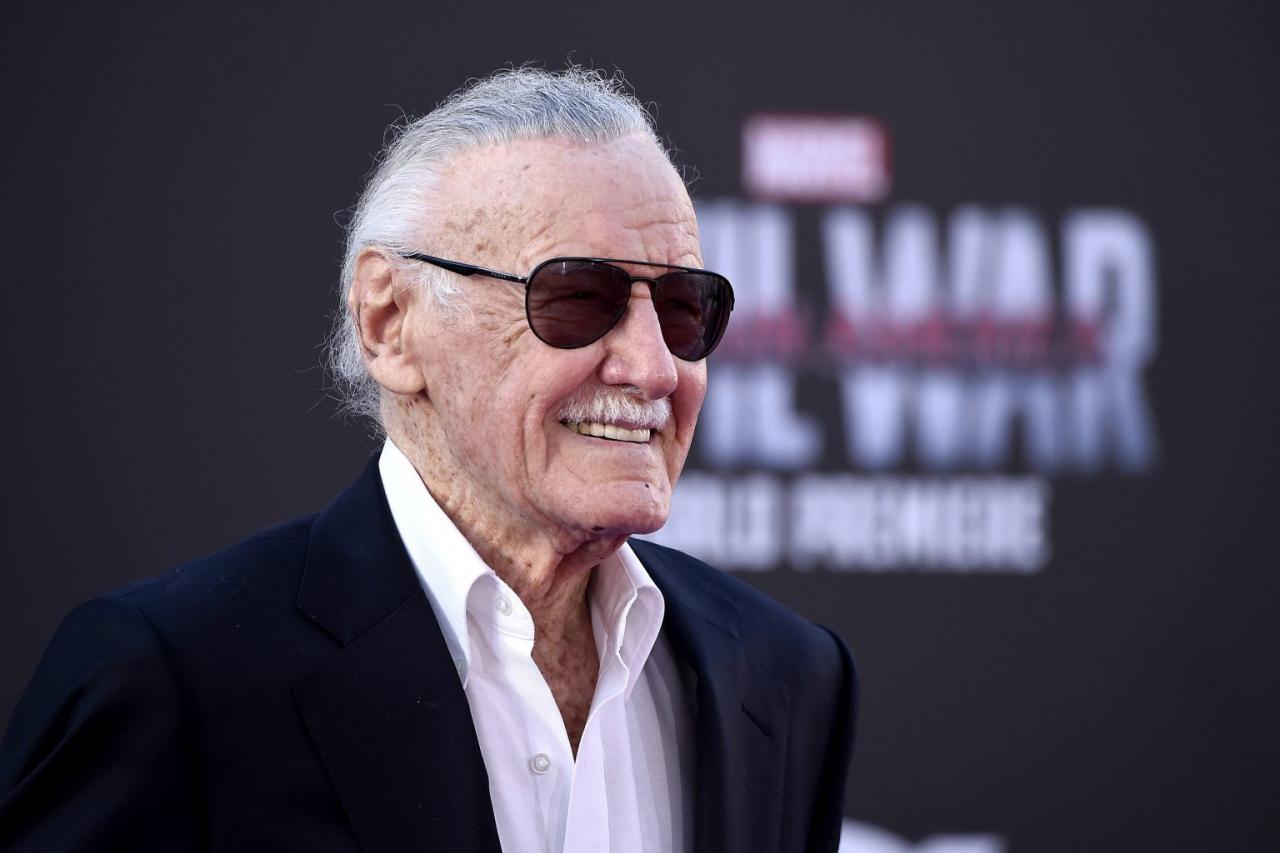

In this comprehensive article, we delve into the fascinating world of payment systems, exploring their evolution, types, and the crucial role they play in our modern economy. Our guide through this journey is the renowned author Martin Goodman, an expert in the field of financial technology.

An introduction to payment systems by Martin Goodman is a must-read for anyone who wants to understand the complex world of electronic payments. Just like how an example of an open source operating system can provide a more secure and customizable computing experience, understanding payment systems can empower you to make informed decisions about how you manage your money.

Types of Payment Systems

Payment systems come in a wide variety, each with its own advantages and disadvantages. Let’s explore some of the most common types:

Cash

- Tangible currency notes and coins

- Advantages: Widely accepted, anonymous, and convenient for small transactions

- Disadvantages: Can be easily lost or stolen, difficult to track, and can facilitate illegal activities

Checks

- Paper documents that instruct a bank to transfer funds from one account to another

- Advantages: Secure and verifiable, provide a written record of transactions

- Disadvantages: Time-consuming to process, can bounce if there are insufficient funds

Credit Cards

- Plastic cards that allow users to borrow money to make purchases

- Advantages: Convenient, widely accepted, offer rewards and benefits

- Disadvantages: Can lead to debt if not used responsibly, high interest rates

Debit Cards

- Plastic cards that directly deduct funds from a user’s checking account

- Advantages: Convenient, secure, no interest charges

- Disadvantages: May have daily withdrawal limits, not as widely accepted as credit cards

Electronic Payment Systems

- Digital platforms that facilitate online and mobile payments

- Advantages: Fast, convenient, and secure, allow for easy international transactions

- Disadvantages: May require internet access, can be vulnerable to fraud

History and Evolution of Payment Systems

Payment systems have evolved dramatically over the centuries, from simple barter systems to the sophisticated electronic methods we use today. Let’s trace this fascinating journey:

Barter Systems

In ancient times, people exchanged goods and services directly without using money.

Martin Goodman’s “An Introduction to Payment Systems” is a must-read for anyone interested in understanding the complex world of payment processing. The book covers everything from the basics of payment systems to the latest innovations in mobile payments. Goodman also provides a detailed overview of the regulatory landscape governing payment systems.

An information system includes hardware, software, data, people, and processes that are organized to collect, process, transmit, and disseminate data in an organization. Goodman’s book is a valuable resource for anyone who wants to learn more about payment systems and their role in the modern economy.

Coins and Currency

Around 600 BC, the first coins were introduced, making it easier to trade and measure value.

An introduction to payment systems by Martin Goodman is a must-read for anyone interested in the world of finance. Goodman, a leading expert in the field, provides a comprehensive overview of the various types of payment systems, from traditional methods like cash and checks to newer technologies like mobile payments and cryptocurrencies.

The book also discusses the regulatory landscape surrounding payment systems and the challenges that they face in the 21st century. If you’re looking to learn more about payment systems, this book is a great place to start. An ESS is an information system that supports the quizlet . Goodman’s writing is clear and concise, and he provides plenty of examples to illustrate his points.

Whether you’re a student, a professional, or just someone who’s curious about the world of finance, this book is a valuable resource.

Paper Money

In the 10th century, paper money was invented in China, providing a more convenient and portable form of currency.

An introduction to payment systems by Martin Goodman provides insights into the fundamental concepts of financial transactions. However, like an integral part of the autonomic nervous system , payment systems play a vital role in the smooth functioning of our financial ecosystem.

Understanding the principles outlined in Goodman’s work can help individuals navigate the complexities of modern payment systems.

Checks and Credit

In the 17th century, checks were developed to facilitate payments over long distances. Credit cards emerged in the 20th century, allowing consumers to borrow money for purchases.

Electronic Payments, An introduction to payment systems martin goodman

The late 20th century saw the rise of electronic payment systems, revolutionizing the way we make transactions.

Role of Payment Systems in the Economy

Payment systems play a vital role in the smooth functioning of the economy:

- Facilitate Transactions:Payment systems enable the exchange of goods and services, allowing businesses and consumers to interact.

- Financial Inclusion:Electronic payment systems can reach underserved populations, providing access to financial services.

- Economic Growth:Efficient payment systems reduce transaction costs and increase economic activity.

Security and Risk Management in Payment Systems

Security is paramount in payment systems. Here are some key considerations:

- Fraud Prevention:Payment systems employ various measures to prevent unauthorized transactions, such as encryption, fraud detection algorithms, and strong authentication.

- Data Protection:Payment systems must protect sensitive financial information from theft and misuse.

- Cybersecurity:Payment systems are vulnerable to cyberattacks, so robust cybersecurity measures are essential.

Future Trends in Payment Systems

Payment systems are constantly evolving. Here are some emerging trends:

- Mobile Payments:Smartphones are becoming increasingly popular for making payments.

- Blockchain Technology:Blockchain offers secure and transparent payment processing.

- Artificial Intelligence:AI is being used to improve fraud detection and personalize payment experiences.

Final Wrap-Up: An Introduction To Payment Systems Martin Goodman

In the ever-evolving landscape of payment systems, Martin Goodman’s comprehensive guide provides a roadmap to navigate the complexities of this fascinating field. With a keen eye for detail and a knack for making complex concepts accessible, Goodman empowers readers to understand the intricacies of payment systems and their profound impact on our financial lives.

Answers to Common Questions

What is the primary purpose of payment systems?

Payment systems enable the secure and efficient transfer of funds between parties, facilitating economic transactions and promoting financial inclusion.

An Introduction to Payment Systems by Martin Goodman provides a comprehensive overview of the various payment systems used in the modern world. It delves into the complexities of payment processing, including the role of intermediaries like banks and credit card companies.

To understand the broader context of payment systems, it’s worth exploring an income tax system in the us abbr , which is an integral part of the financial landscape. By examining the different types of income taxes and their impact on individuals and businesses, one can gain a deeper understanding of the payment systems that facilitate the flow of funds within the economy.

Returning to Goodman’s work, An Introduction to Payment Systems offers valuable insights into the evolving nature of payment technologies and their implications for the future of financial transactions.

How have technological advancements influenced the evolution of payment systems?

Technological advancements have revolutionized payment systems, introducing electronic payment methods, mobile payments, and blockchain technology, which have enhanced convenience, security, and global reach.

What are the key security considerations in payment systems?

Payment systems must prioritize security measures to protect against fraud, data breaches, and other vulnerabilities. Best practices include encryption, strong authentication protocols, and regular security audits.

Hey, payment systems guru Martin Goodman has got you covered with his deep dive into the world of payments. If you’re curious about how things flow in different systems, check out an example of lotic system to see how water behaves in a specific type of ecosystem.

But don’t get sidetracked; Goodman’s got all the payment system knowledge you need!

An introduction to payment systems by Martin Goodman is a must-read for anyone interested in the fascinating world of finance. Goodman provides a comprehensive overview of the different types of payment systems, from traditional methods like cash and checks to modern innovations like mobile payments and cryptocurrencies.

Along the way, he delves into the complexities of an immune system cell called the plasma cell , which produces thousands of antibodies to fight off infection. Goodman’s book is a valuable resource for anyone who wants to understand the intricacies of payment systems and their impact on our daily lives.