An activity-based costing system quizlet – Prepare to dive into the fascinating world of activity-based costing systems with our engaging quizlet! This interactive guide will empower you to master the concepts, components, and applications of this powerful tool. Buckle up and get ready to uncover the secrets of cost analysis like never before.

Check out this activity-based costing system quizlet to brush up on your knowledge of this accounting method. If you’re looking to learn more about the broader concept of information systems, check out the 4 major components of an information system . This article covers the hardware, software, data, and procedures that make up an information system.

Returning to activity-based costing systems, this quizlet will help you understand how to allocate costs based on activities, providing valuable insights for your financial analysis.

Activity-based costing systems are the ultimate game-changer in the realm of cost accounting. By diving into the details of this innovative approach, you’ll gain a deeper understanding of how costs are assigned to activities, products, and services. Get ready to revolutionize your cost analysis skills and make informed decisions that drive your business to success.

An activity-based costing system quizlet can help you understand how to allocate costs to activities, which is essential for making informed decisions. According to Charles Pfleeger , an information system is secure when it protects against unauthorized access, use, disclosure, disruption, modification, or destruction of information.

This is important for businesses of all sizes, as it can help them protect their data and avoid costly security breaches. An activity-based costing system quizlet can help you understand how to implement these security measures and ensure that your information system is secure.

Introduction to Activity-Based Costing Systems: An Activity-based Costing System Quizlet

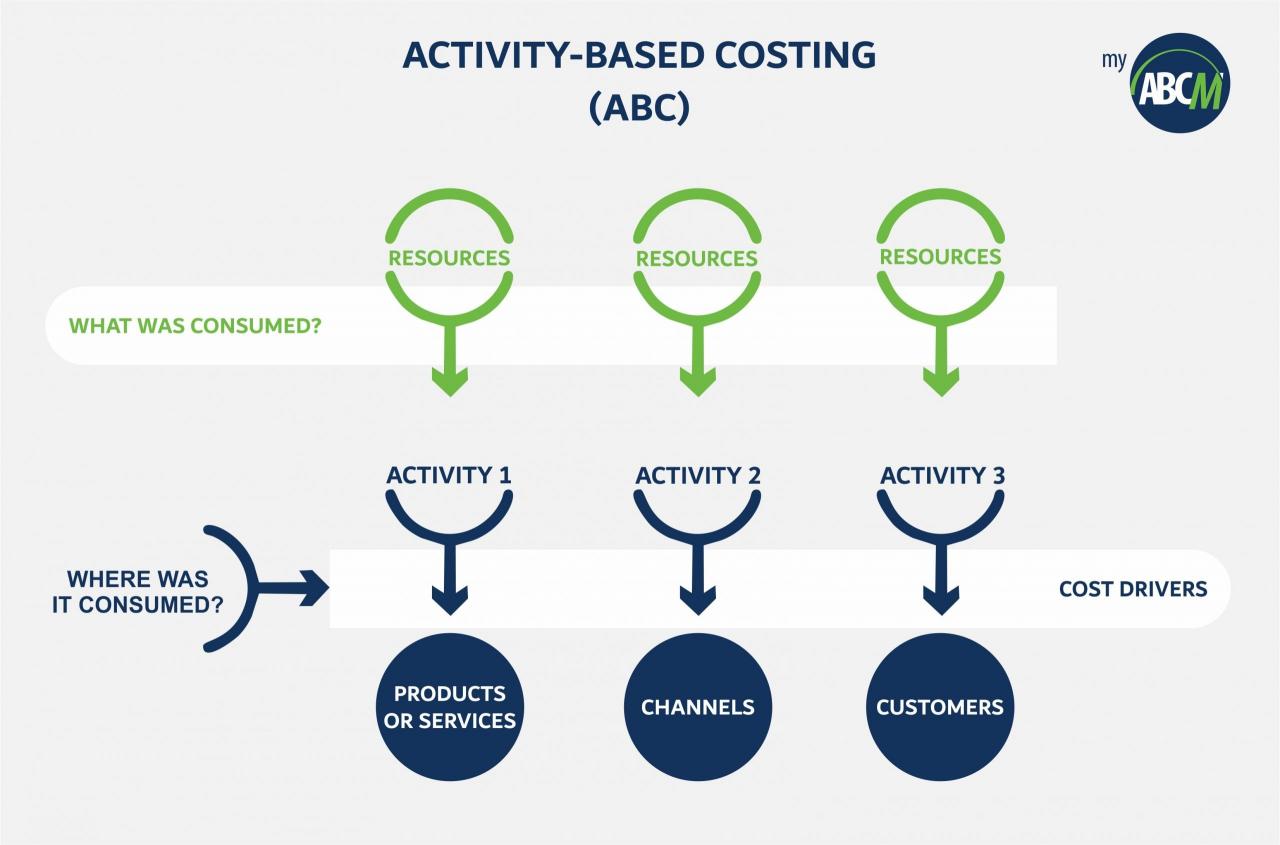

Activity-based costing (ABC) is a costing system that assigns costs to activities and then assigns those costs to products and services based on the activities they consume. This system provides a more accurate picture of costs than traditional costing systems, which allocate costs based on volume or other indirect measures.

An activity-based costing system quizlet is a great way to learn about this complex topic. And while you’re studying, why not take a break and check out a modern structure that uses an arch and dome system ? It’s a beautiful example of how these architectural elements can be used to create a stunning and unique building.

Then, come back here and finish up your studying. You’ll be glad you did!

ABC systems are beneficial because they:

- Provide a more accurate picture of costs

- Help identify cost drivers

- Support better decision-making

However, ABC systems can also be complex and expensive to implement. They may not be suitable for all organizations.

An activity-based costing system quizlet can help you understand how to allocate costs to activities. For example, you might use an activity-based costing system to allocate costs to different crops in a farming operation. If you’re interested in learning more about agricultural innovation systems, I recommend checking out the agricultural innovation systems an investment sourcebook . It’s a great resource for anyone who wants to learn more about how to invest in agricultural innovation.

After reading the sourcebook, you can come back to the activity-based costing system quizlet to test your knowledge.

Key Components of Activity-Based Costing Systems

The key components of an ABC system are:

- Activities: Activities are the tasks that are performed in an organization. They can be categorized as either value-added or non-value-added activities.

- Cost drivers: Cost drivers are the factors that cause costs to vary. They can be classified as either activity-related or transaction-related.

- Activity rates: Activity rates are the costs of performing activities. They are calculated by dividing the total cost of an activity by the number of units of the cost driver.

These components work together to provide a more accurate picture of costs by assigning costs to products and services based on the activities they consume.

Yo, check this out! This activity-based costing system quizlet is the bomb. It’s like, the ultimate guide to understanding this accounting stuff. But wait, there’s more! Did you know that there are also these 5 fundamental principles of an islamic economic system ? Yeah, it’s like, a whole other world of finance.

But don’t worry, you can still rock this activity-based costing quizlet and become an accounting ninja!

Activity-Based Costing System Implementation

The steps involved in implementing an ABC system are:

- Identify the activities that are performed in the organization.

- Classify the activities as either value-added or non-value-added activities.

- Identify the cost drivers that cause costs to vary.

- Classify the cost drivers as either activity-related or transaction-related.

- Calculate the activity rates for each activity.

- Assign costs to products and services based on the activities they consume.

ABC systems have been implemented in a variety of organizations, including manufacturing, service, and non-profit organizations.

Applications of Activity-Based Costing Systems

ABC systems can be used for a variety of purposes, including:

- Cost management: ABC systems can help organizations identify cost drivers and reduce costs.

- Pricing: ABC systems can help organizations set prices for products and services.

- Product design: ABC systems can help organizations design products and services that are more cost-effective.

- Process improvement: ABC systems can help organizations identify and improve processes that are inefficient.

ABC systems have been used to improve decision-making in a variety of organizations.

An activity-based costing system quizlet can be a helpful tool for understanding how costs are assigned to activities. By understanding how costs are assigned, you can better manage your costs and improve your profitability. If you’re looking for a good operating system for your computer, there are many to choose from.

Here are 3 examples of an operating system that are popular among users: Windows, macOS, and Linux. Once you’ve chosen an operating system, you can start using your computer to complete tasks and activities.

Challenges of Activity-Based Costing Systems

The challenges associated with implementing and using ABC systems include:

- Complexity: ABC systems can be complex and expensive to implement.

- Data requirements: ABC systems require a large amount of data, which can be difficult to collect and maintain.

- Accuracy: ABC systems are only as accurate as the data that is used to create them.

However, there are strategies that can be used to overcome these challenges.

Closing Notes

As we conclude our exploration of activity-based costing systems, remember that they are not just a theoretical concept but a powerful tool that can transform your organization’s financial decision-making. By embracing the principles and overcoming the challenges associated with ABC systems, you can unlock a wealth of insights that will empower you to optimize costs, improve profitability, and gain a competitive edge in today’s dynamic business landscape.

Q&A

What are the key benefits of using an activity-based costing system?

ABC systems provide greater cost accuracy, improved product costing, better decision-making, and enhanced profitability.

What are the challenges associated with implementing an activity-based costing system?

Data collection, cost driver identification, and system complexity can pose challenges during implementation.

How can organizations overcome the challenges of implementing an activity-based costing system?

Effective planning, clear communication, and ongoing monitoring and evaluation are crucial for successful implementation.

An activity-based costing system quizlet can help you master the complexities of cost accounting. To get a broader understanding of computer systems, check out the 5 main functions of an operating system . These functions are essential for managing hardware, software, and user interactions.

Returning to activity-based costing, this system provides valuable insights into the true costs of activities and products.