Accounting is an information system explain – Unravel the enigmatic world of accounting, where it unveils its true nature as an indispensable information system. As we delve into its depths, we’ll uncover how accounting meticulously gathers, processes, and disseminates financial data, empowering businesses and individuals alike to make informed decisions that shape their destinies.

Understanding accounting as an information system is crucial. It provides a solid foundation for deciphering financial data, much like the principles that govern an Islamic economic system. The 5 fundamental principles of an islamic economic system emphasize fairness, social justice, and ethical behavior, mirroring the transparency and accountability inherent in accounting systems.

Accounting, the backbone of any successful enterprise, transcends its traditional role as a mere record-keeper. It has evolved into a sophisticated information system that provides invaluable insights into the financial health and performance of organizations, enabling stakeholders to navigate the complexities of modern business.

1. Define accounting as an information system: Accounting Is An Information System Explain

Accounting is an information system that provides information about a company’s financial performance and position. It is a tool that helps managers make informed decisions about the company’s operations.

An information system is a set of components that work together to collect, store, process, and distribute information. Accounting systems are designed to provide information about a company’s financial transactions, assets, liabilities, and equity.

Accounting, like a living being is an autonomous system , records, classifies, and summarizes financial transactions to provide information that helps decision-makers make informed choices. Just as a living being maintains its internal environment, accounting maintains the financial health of an organization.

Accounting fits into the definition of an information system because it meets all of the following criteria:

- It collects data about a company’s financial transactions.

- It stores the data in a way that makes it easy to retrieve.

- It processes the data to create financial statements and other reports.

- It distributes the information to users who need it.

2. Explain the role of accounting in providing information to users

Accounting plays a vital role in providing information to users. The information that accounting provides can be used to make informed decisions about a company’s financial performance and position.

Accounting is an information system that provides financial data to users. This data is used to make decisions about the allocation of resources. A control is an activity, device, practice, procedure, system, or check that helps to ensure the accuracy and reliability of financial data.

Controls are important because they help to prevent errors and fraud. They also help to ensure that financial data is used in a way that is consistent with the organization’s goals.

The different types of users of accounting information include:

- Investors

- Creditors

- Managers

- Government agencies

The types of information that accounting provides to each user group include:

- Investors: Accounting information can help investors make informed decisions about whether to buy, sell, or hold a company’s stock.

- Creditors: Accounting information can help creditors make informed decisions about whether to lend money to a company.

- Managers: Accounting information can help managers make informed decisions about how to operate a company.

- Government agencies: Accounting information can help government agencies make informed decisions about how to regulate companies.

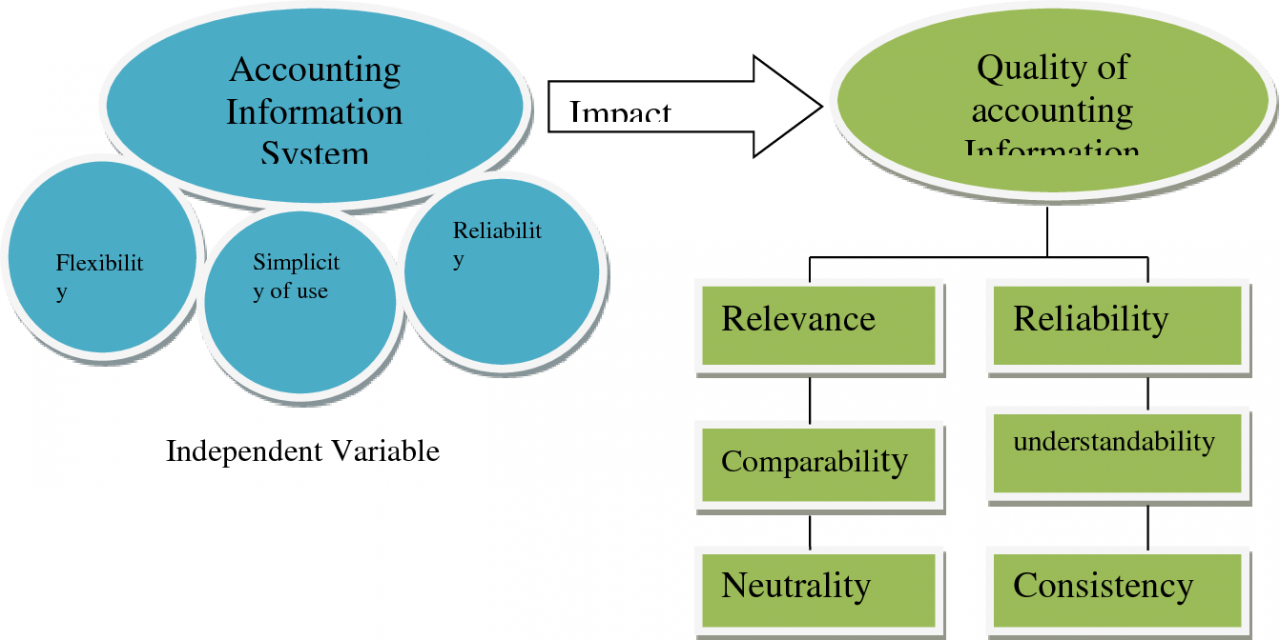

3. Discuss the different components of an accounting information system

An accounting information system is made up of several different components. These components work together to collect, store, process, and distribute accounting information.

The general ledger is the central component of an accounting information system. The general ledger is a record of all of a company’s financial transactions. It is used to create financial statements and other reports.

The different types of accounts used in an accounting system include:

- Asset accounts

- Liability accounts

- Equity accounts

- Revenue accounts

- Expense accounts

The process of recording transactions in an accounting system involves the following steps:

- Identify the transaction.

- Determine the accounts that are affected by the transaction.

- Record the transaction in the general ledger.

- Update the financial statements.

4. Describe the process of generating financial statements

Financial statements are reports that provide information about a company’s financial performance and position. The three main financial statements are the income statement, the balance sheet, and the statement of cash flows.

Accounting is an information system that provides financial data to users. Like an operating system, which acts as a bridge between the hardware and software of a computer, accounting bridges the gap between financial data and users. Just as there are 2 examples of an operating system , there are also various types of accounting systems designed to meet the specific needs of different organizations.

The purpose of financial statements is to provide users with information that they can use to make informed decisions about a company.

Accounting is an information system that provides information about a company’s financial health. This information can be used to make decisions about how to run the company, such as how much to invest in new products or how to manage cash flow.

A payroll system is a typical example of an MIS. A payroll system is a computer program that calculates and prints paychecks for employees. It also keeps track of employee hours worked, deductions, and other payroll information. Payroll systems are essential for businesses of all sizes, and they can help to ensure that employees are paid accurately and on time.

Accounting is an information system that provides information about a company’s financial health. This information can be used to make decisions about how to run the company, such as how much to invest in new products or how to manage cash flow.

The different types of financial statements include:

- Income statement: The income statement shows a company’s revenues and expenses over a period of time.

- Balance sheet: The balance sheet shows a company’s assets, liabilities, and equity at a specific point in time.

- Statement of cash flows: The statement of cash flows shows a company’s cash inflows and outflows over a period of time.

The process of preparing financial statements involves the following steps:

- Collect the necessary data.

- Analyze the data.

- Prepare the financial statements.

- Review the financial statements.

5. Discuss the importance of accounting in decision-making

Accounting information is essential for making informed decisions about a company’s financial performance and position. Accounting information can be used to make decisions about:

- Investing

- Lending

- Operating a company

- Regulating companies

Accounting information has been used to make many successful decisions. For example, accounting information was used to make the decision to invest in the stock of Apple Inc. This decision has been very successful, as Apple Inc. has become one of the most valuable companies in the world.

Accounting is an information system that captures, processes, and communicates financial data. These systems typically include five key components : hardware, software, data, procedures, and people. Hardware and software are the physical and digital tools that make up the system, while data is the raw material that is processed by the system.

Procedures are the rules and instructions that govern how the system operates, and people are the users who interact with the system.

Final Review

In the tapestry of business, accounting stands as a vibrant thread, connecting disparate elements into a cohesive whole. It weaves together financial data, transforming it into a symphony of information that guides decision-making, fosters transparency, and ensures accountability. As the world of business continues to evolve at an unrelenting pace, accounting will undoubtedly remain an indispensable tool, empowering organizations to thrive in an ever-changing landscape.

Key Questions Answered

What is the primary function of an accounting information system?

Accounting is an information system that provides information about a company’s financial health. Operating systems , such as Windows, macOS, and Linux, are software that manage computer hardware and software resources. Accounting information systems use operating systems to run and store data, which is then used to generate financial reports and statements.

An accounting information system’s primary function is to capture, process, and communicate financial data to internal and external users.

How does accounting information help businesses make better decisions?

Accounting information provides insights into a company’s financial performance, liquidity, and solvency, enabling managers to make informed decisions about resource allocation, investments, and strategic planning.

What are the different types of financial statements generated by an accounting information system?

Common financial statements include the balance sheet, income statement, and cash flow statement, each providing a distinct perspective on a company’s financial health.