An effective financial system needs which of the following – An effective financial system is the backbone of a thriving economy, providing stability, accessibility, efficiency, and inclusivity. From financial intermediaries to regulatory frameworks and financial markets, a well-structured system ensures the smooth flow of capital and supports economic growth.

This comprehensive guide delves into the essential elements of an effective financial system, exploring its pillars, the role of financial intermediaries, the importance of regulation, the functions of financial markets, and the significance of access to finance. We’ll also examine the challenges and risks associated with financial systems and discuss strategies for mitigating them.

Pillars of an Effective Financial System: An Effective Financial System Needs Which Of The Following

An effective financial system is the backbone of a healthy economy. It provides the framework for the efficient allocation of financial resources, facilitates economic growth, and ensures stability.

Key characteristics of an effective financial system include stability, accessibility, efficiency, and inclusivity. Stability refers to the ability of the system to withstand shocks and maintain its integrity. Accessibility ensures that financial services are available to all segments of the population, including individuals, businesses, and governments.

Efficiency implies that financial transactions are executed smoothly and at low cost. Inclusivity promotes broad participation in the financial system, fostering economic growth and reducing inequality.

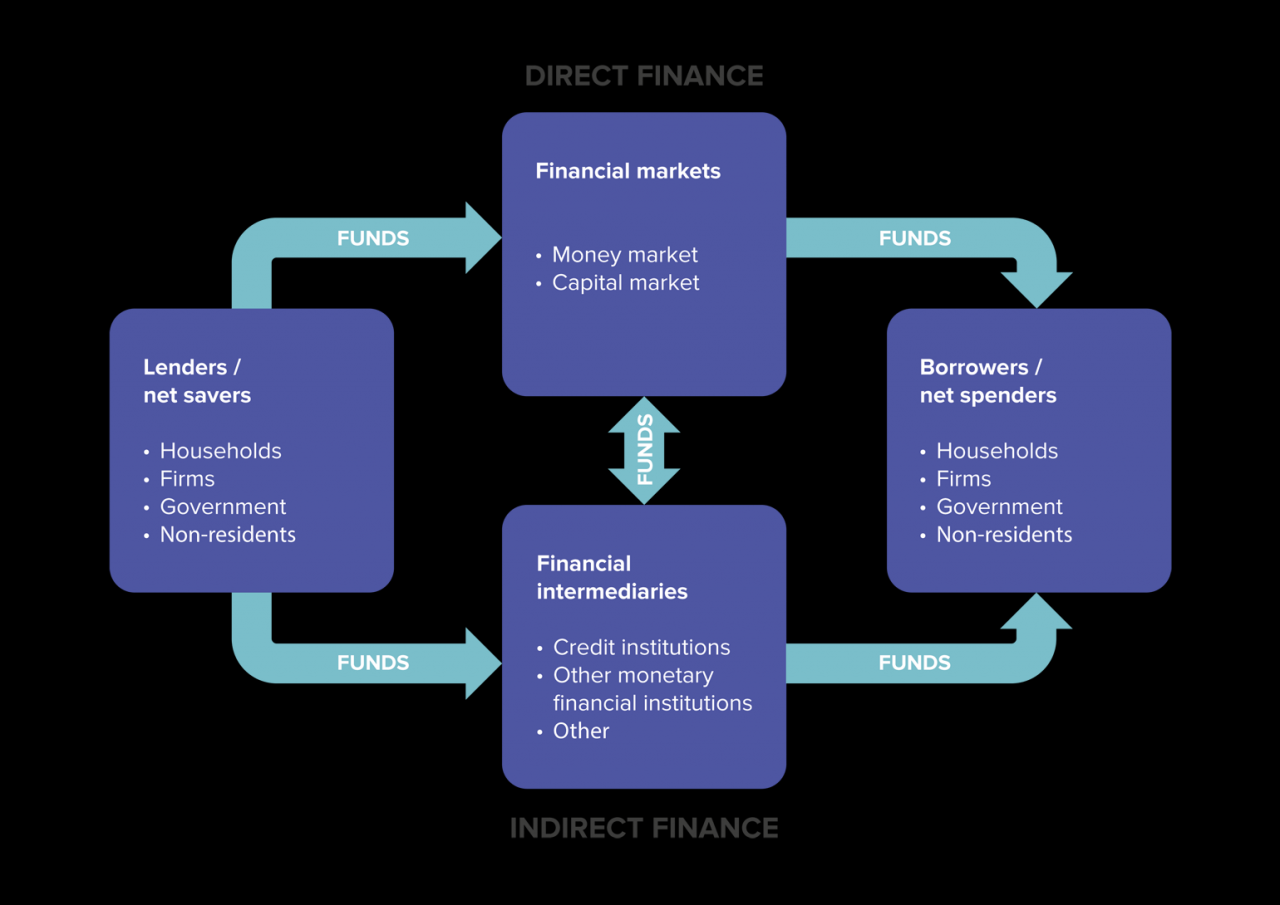

Role of Financial Intermediaries

Financial intermediaries play a crucial role in the financial system by facilitating financial transactions and managing risk. They include banks, insurance companies, investment firms, and other institutions.

Banks accept deposits from individuals and businesses and lend them out to borrowers. They also provide a range of other services, such as checking and savings accounts, credit cards, and investment products.

An effective financial system needs efficient information exchange. Inter-enterprise information systems , like online banking, facilitate seamless data sharing between financial institutions and customers. This integration enables real-time transactions, enhanced security, and personalized financial services, ultimately contributing to a robust and accessible financial system.

Insurance companies provide protection against financial losses due to events such as accidents, illness, or death. They collect premiums from policyholders and use them to pay out claims when necessary.

Investment firms help individuals and businesses invest their money in a variety of assets, such as stocks, bonds, and mutual funds. They provide research and advice to help investors make informed decisions.

An effective financial system requires transparency, stability, and efficiency. While the financial world may seem daunting, advancements in technology have made managing your finances easier than ever before. For instance, you can now use Alexa as an intercom system to monitor your accounts and stay informed about your financial health.

This integration of technology into financial management empowers individuals to take control of their finances and make informed decisions. An effective financial system should empower individuals with the tools they need to succeed.

Regulatory Framework

A robust regulatory framework is essential for maintaining financial stability. It ensures that financial institutions operate in a safe and sound manner and protects consumers from fraud and abuse.

Government agencies and central banks play a key role in regulating the financial system. They set rules and regulations, supervise financial institutions, and take enforcement actions when necessary.

An effective financial system needs an accounting system that provides a clear picture of a company’s financial health. An accounting system is a set of rules and procedures that companies use to record, classify, and summarize financial transactions to provide information that is useful for making business decisions.

Financial Markets

Financial markets are platforms where buyers and sellers of financial assets come together to trade. They include equity markets, bond markets, and foreign exchange markets.

Yo, check it! An effective financial system needs to have it all: security, transparency, and data that’s stored in one slick spot. And guess what? All transactional data in an ERP system is just that – stored in one central hub.

So, whether you’re tracking cash flow, managing invoices, or crushing it with budgeting, you got all the info you need right at your fingertips. That’s the power of an effective financial system, baby!

Equity markets facilitate the trading of stocks, which represent ownership in publicly traded companies. Bond markets allow governments and corporations to borrow money by issuing bonds.

Foreign exchange markets enable the exchange of currencies between different countries.

Access to Finance

Ensuring broad access to financial services is essential for economic growth and social equity. It allows individuals and businesses to obtain the financial resources they need to invest, innovate, and grow.

Strategies to promote financial inclusion include expanding access to bank accounts, providing affordable credit, and educating consumers about financial management.

Financial Innovation

Financial innovation is the development of new financial products and services. It can lead to greater efficiency, reduced costs, and increased access to finance.

An effective financial system needs to have an accounting information system that is a set of interrelated components that work together to provide financial information. This information is used by managers to make decisions about the company’s financial future. An effective financial system also needs to have internal controls in place to ensure that the financial information is accurate and reliable.

Emerging technologies, such as blockchain and artificial intelligence, are transforming financial services. They have the potential to make financial transactions more secure, transparent, and efficient.

Challenges and Risks, An effective financial system needs which of the following

Financial systems are subject to a variety of challenges and risks, including systemic crises, fraud, and cyber threats.

Systemic crises can occur when a major financial institution fails or when there is a widespread loss of confidence in the financial system. Fraud involves the intentional deception of consumers or investors for financial gain.

Cyber threats can compromise the security of financial systems and lead to data breaches or financial losses.

Last Word

In conclusion, an effective financial system is not merely a collection of institutions and regulations; it’s a dynamic ecosystem that fosters economic prosperity. By understanding its key components and embracing innovation while managing risks, we can create financial systems that serve the needs of individuals, businesses, and the economy as a whole.

FAQ Section

What are the key characteristics of an effective financial system?

Stability, accessibility, efficiency, and inclusivity are the cornerstones of an effective financial system.

What is the role of financial intermediaries in the financial system?

Financial intermediaries, such as banks, insurance companies, and investment firms, facilitate financial transactions, manage risk, and provide access to financial services.

Why is a robust regulatory framework important for financial stability?

To build an effective financial system, we need a number of things, including a central bank, a system of regulation, and a stable currency. Just like how an air conditioning system is needed for a new warehouse , these components are essential for a well-functioning financial system.

A robust regulatory framework ensures that financial institutions operate safely and responsibly, protecting consumers and maintaining the stability of the financial system.

What are the different types of financial markets?

An effective financial system needs transparency, stability, and efficiency. A systems analysis of an ecosystem could involve studying the interactions between different components , such as the financial system and the environment. By understanding these interactions, we can better understand how to create a more effective financial system.

Financial markets include equity markets, bond markets, and foreign exchange markets, each serving a specific purpose in mobilizing capital and facilitating investment.

How can we promote financial inclusion and reduce barriers to financial participation?

Strategies to promote financial inclusion include expanding access to financial services, providing financial education, and addressing systemic barriers that prevent individuals and businesses from participating in the financial system.