An automated accounting system can keep track of accounts receivable, streamlining your financial processes and giving you peace of mind. By automating tasks such as invoicing, payment tracking, and reconciliation, you can save time, reduce errors, and improve cash flow.

An automated accounting system can keep track of accounts receivable, ensuring that you always know what’s owed to you. This is a huge advantage over manual systems, which are more prone to errors and can be difficult to keep up with.

As a p system has an advantage over the q system , an automated accounting system can also help you to improve your cash flow and make better financial decisions. With an automated accounting system, you can be sure that your accounts receivable are being managed efficiently and effectively.

Dive into this guide to discover the benefits of an automated accounting system and how it can revolutionize your accounts receivable management.

An automated accounting system can keep track of accounts receivable, just like a living being is an autonomous system . An autonomous system can regulate its own functions, such as maintaining homeostasis. Similarly, an automated accounting system can regulate its own functions, such as tracking accounts receivable and generating reports.

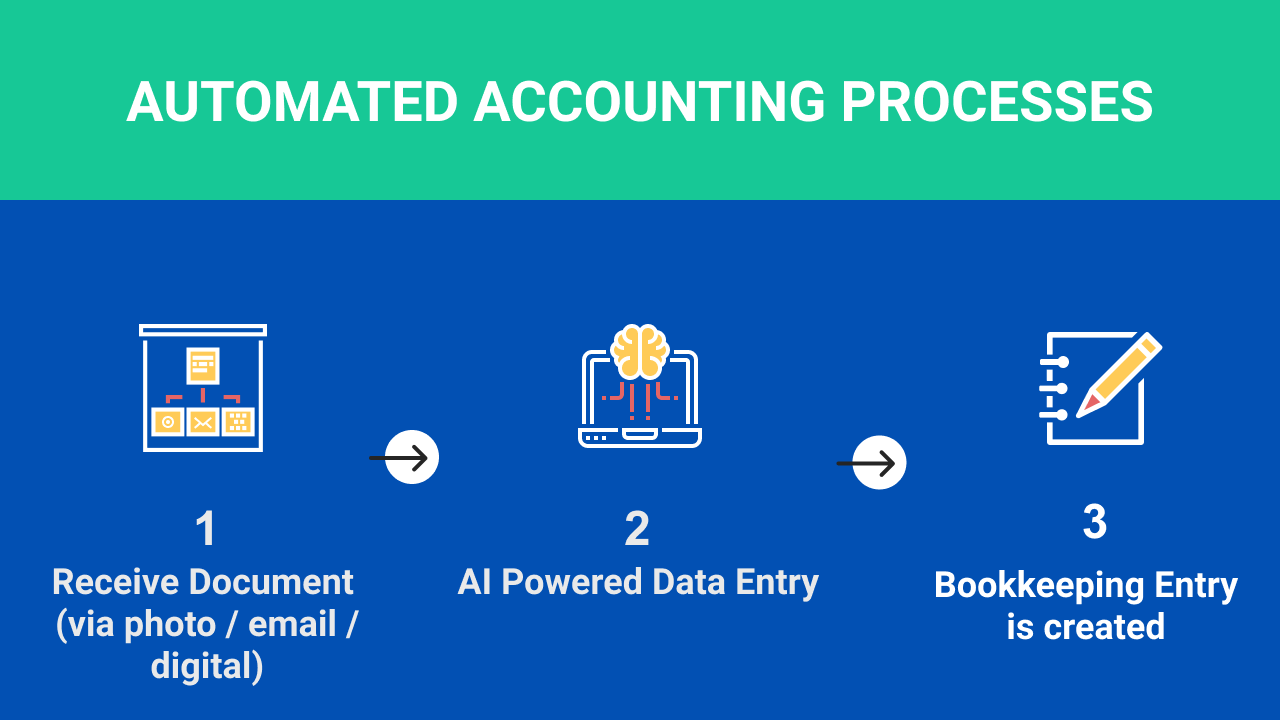

Overview of Automated Accounting Systems

Automated accounting systems leverage technology to streamline and enhance accounting processes, minimizing manual effort and improving accuracy and efficiency. They encompass a wide range of tasks, including:

Benefits of Automated Accounting Systems

- Enhanced accuracy and reduced errors

- Increased efficiency and productivity

- Real-time visibility into financial data

- Improved compliance and reduced risk

Accounts Receivable Management in Automated Systems

Automated systems track accounts receivable seamlessly, recording and managing invoices, payments, and related transactions. They:

Importance of Accurate and Timely Accounts Receivable Tracking, An automated accounting system can keep track of accounts receivable

- Improves cash flow management

- Reduces bad debts and improves revenue recognition

- Strengthens customer relationships

Integration with Other Accounting Functions

Automated accounting systems integrate seamlessly with other accounting functions, such as accounts payable and general ledger, enabling:

Benefits of Having a Fully Integrated Accounting System

- Elimination of data entry duplication

- Improved data accuracy and consistency

- Real-time financial reporting

Data Security and Compliance

Automated accounting systems prioritize data security and compliance through:

Compliance Requirements for Automated Systems

- Adherence to industry standards and regulations

- Implementation of data encryption and access controls

- Regular security audits and updates

Implementation and Best Practices: An Automated Accounting System Can Keep Track Of Accounts Receivable

Successful implementation of automated accounting systems requires:

Best Practices for Optimizing Automated Systems

- Thorough planning and analysis

- Involvement of key stakeholders

- Proper training and support

Emerging Trends in Automated Accounting

The future of automated accounting holds exciting trends, including:

Potential Impact of Emerging Trends on the Accounting Profession

- Increased automation and efficiency

- Enhanced data analytics and decision-making

- New career opportunities in data analysis and automation

Closure

In conclusion, an automated accounting system is an indispensable tool for businesses looking to optimize their accounts receivable management. By automating tasks, improving accuracy, and integrating with other accounting functions, businesses can streamline their financial processes, reduce costs, and gain valuable insights into their financial performance.

An automated accounting system can keep track of accounts receivable, ensuring that you always know what’s owed to you. This can be a huge help for businesses of all sizes, as it can free up your time to focus on other things.

As an advocate of just-in-time inventory system would advocate , it can also help you to improve your cash flow and reduce your risk of bad debt. An automated accounting system can help you to stay on top of your finances and make better decisions for your business.

Embrace the future of accounting and unlock the full potential of your accounts receivable with an automated accounting system.

FAQ Resource

What are the benefits of using an automated accounting system?

With an automated accounting system keeping tabs on your accounts receivable, you’re covered. But to really get your ducks in a row, check out an activity based cost allocation system . It’ll break down costs based on activities, giving you a clear picture of where your money’s going.

And when you combine that with your automated accounting system, you’ll be the king of cash flow!

Automated accounting systems offer numerous benefits, including reduced errors, improved efficiency, time savings, enhanced data security, and better compliance.

How does an automated accounting system track accounts receivable?

Automated accounting systems not only keep track of accounts receivable but also streamline the entire accounting process. In fact, you could say they’re the Alexa of accounting, automating tasks and providing real-time insights. Just like Alexa can be used as an intercom system , these systems can integrate with other software, allowing you to manage your finances with ease.

So, if you’re looking to simplify your accounting and gain a competitive edge, consider implementing an automated accounting system today.

Automated accounting systems track accounts receivable by recording customer invoices, payments, and adjustments in a centralized database. This allows businesses to easily monitor the status of their accounts receivable and identify any outstanding balances.

Is an automated accounting system right for my business?

An automated accounting system is a suitable solution for businesses of all sizes that want to streamline their financial processes, improve accuracy, and gain better control over their accounts receivable.

An automated accounting system can keep track of accounts receivable, ensuring your business stays on top of its finances. Like an adiabatic capillary tube used in some refrigeration systems , an automated accounting system can help you maintain efficiency and accuracy in your financial operations, freeing up your time to focus on other aspects of your business.

An automated accounting system can keep track of accounts receivable, which is a key part of any business. In fact, it is an example of an inter-enterprise information system , which means that it can share data with other systems, such as a customer relationship management (CRM) system.

This can help businesses to improve their efficiency and make better decisions.