An accounting information system (AIS) is the backbone of any organization’s financial management. It’s like the central nervous system of a business, collecting, processing, and distributing financial data to decision-makers. Without an effective AIS, businesses would be flying blind, unable to track their financial performance or make informed decisions about the future.

An accounting information system, a crucial tool for managing financial data, operates like a system with infinite solutions . It allows users to customize and adapt it to their specific needs, providing flexibility and adaptability that empowers them to navigate the complexities of financial management.

In this comprehensive guide, we’ll dive deep into the world of AIS, exploring its functions, types, design, implementation, and security measures. We’ll also take a peek into the future, examining emerging trends that are shaping the way accounting information is managed and used.

Overview of an Accounting Information System

In the realm of business, an accounting information system (AIS) stands as a cornerstone of financial management and decision-making. It’s like the trusty sidekick to accounting professionals, providing the essential tools to capture, process, and report financial data with unparalleled accuracy and efficiency.

Accounting information systems are like the brains of a business, keeping track of all the financial transactions. Without them, it would be like trying to use a computer without an operating system – you’d have a lot of hardware, but no way to make it work.

Accounting information systems provide the structure and organization needed to make sense of all the financial data, helping businesses make informed decisions and stay on top of their finances.

An AIS serves as the backbone of an organization’s accounting function, enabling it to meet its financial reporting obligations, make informed decisions, and maintain compliance with regulations.

The AIS operates like a well-oiled machine, seamlessly integrating various components such as transaction processing, financial reporting, and internal controls. It’s the gatekeeper of financial information, ensuring its integrity and reliability, and safeguarding it from unauthorized access and manipulation.

Implementing an effective AIS brings a treasure trove of benefits to organizations. It streamlines accounting processes, reduces errors, and enhances the accuracy and timeliness of financial reporting. It’s like having a financial GPS, guiding organizations towards informed decision-making and improved financial performance.

Key Components of an AIS

- Transaction Processing:The heart of the AIS, capturing and recording financial transactions with precision.

- Financial Reporting:The storyteller of the financial world, transforming raw data into meaningful financial statements.

- Internal Controls:The guardians of financial integrity, ensuring the accuracy and reliability of financial information.

Functions of an Accounting Information System

An AIS is the Swiss Army knife of accounting, performing a multitude of functions that keep the financial world spinning. It’s the maestro of financial data, orchestrating a symphony of tasks that would leave any accountant dancing with joy.

One of its primary roles is to record, process, and report financial transactions. It’s like a financial timekeeper, meticulously capturing every penny that flows in and out of an organization, leaving no transaction unaccounted for.

An accounting information system is a slick tool that keeps track of all the dough flowing in and out of your business. It’s like a super-organized accountant that never gets tired or makes mistakes. Now, think of a basic telephone system, which is a simple way to connect people over long distances . In the same way, an accounting information system helps connect all the financial data in your business, giving you a clear picture of where you stand.

It’s like having a money GPS that keeps you on track and helps you make smart decisions.

But the AIS doesn’t stop there. It’s also the financial translator, transforming raw transaction data into meaningful financial statements. These statements are the storytellers of an organization’s financial health, providing insights into its performance, profitability, and overall financial well-being.

Types of Accounting Information Systems

When it comes to AISs, there’s no one-size-fits-all solution. Organizations can choose from a smorgasbord of options, each with its own unique flavor.

Manual AIS

The old-school approach, where accounting records are meticulously maintained by hand. It’s like a financial diary, with every transaction carefully inscribed on paper.

An accounting information system is like the central nervous system for your business, keeping track of all the financial data that flows in and out. Just like how a university might upgrade its old accounting system with a new one a university accounting system that replaces an existing system , an accounting information system can be customized to meet the specific needs of your organization, providing real-time insights into your financial performance.

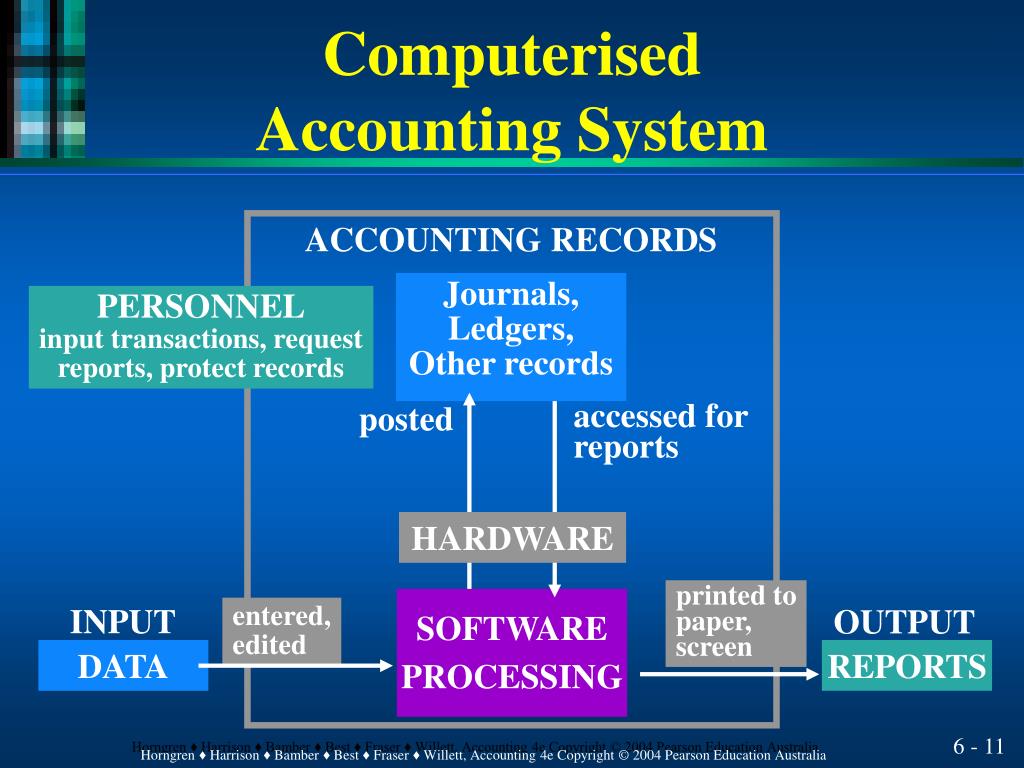

Computerized AIS

The digital revolution has made its mark on AISs. Computerized systems automate many accounting tasks, increasing efficiency and reducing errors. It’s like having a financial robot, tirelessly crunching numbers and generating reports.

An accounting information system, like a well-oiled machine, provides real-time data for decision-making. Its precision resembles the unity feedback system where open loop transfer functions ensure accuracy. By incorporating these principles, accounting systems deliver reliable financial insights, empowering businesses to navigate the ever-changing landscape with confidence.

Cloud-Based AIS, An accounting information system

The cloud has taken AISs to new heights. These systems store financial data online, allowing access from anywhere, anytime. It’s like having your accounting department in your pocket, always at your fingertips.

Design and Implementation of an Accounting Information System

Designing and implementing an AIS is like building a financial fortress, requiring careful planning and execution. It’s a journey that begins with understanding the organization’s unique needs and objectives.

An accounting information system (AIS) is like a GPS for your finances, keeping track of every penny and dollar. But what if we take a detour and go on a virtual space adventure? Check out a trip through our solar system an internet scavenger hunt to explore the wonders of the cosmos.

Then, come back to your AIS and see how it can help you navigate the financial galaxy.

Stakeholder involvement is paramount, ensuring that the AIS aligns with the organization’s vision and goals. It’s like having a financial orchestra, where every stakeholder plays a harmonious tune.

An accounting information system provides the backbone for financial reporting and decision-making. By streamlining processes and centralizing data, it can significantly improve efficiency and accuracy. However, when it comes to implementing an ERP system, which integrates various business functions into a single platform, there are both advantages and disadvantages to consider.

These range from improved collaboration and reduced costs to potential implementation challenges and ongoing maintenance expenses. Understanding these factors is crucial for organizations looking to optimize their accounting information system and leverage the benefits of ERP technology.

Challenges may arise along the way, but with the right strategies and best practices, organizations can navigate these hurdles and emerge with a robust and effective AIS.

Security and Control in an Accounting Information System

In the digital age, security and control are non-negotiable for AISs. They’re the guardians of financial data, protecting it from unauthorized access and malicious intent.

Organizations must be vigilant against threats to AIS security, such as hacking, fraud, and data breaches. It’s like having a financial SWAT team, ready to neutralize any threats that may arise.

Internal controls are the backbone of AIS security, ensuring the accuracy and reliability of financial information. They’re like financial watchdogs, keeping a watchful eye over every transaction and process.

Emerging Trends in Accounting Information Systems

The world of AISs is constantly evolving, with new technologies emerging at lightning speed. Artificial intelligence (AI), blockchain, and data analytics are just a few of the game-changers shaping the future of accounting.

AI is revolutionizing AISs, automating tasks, enhancing data analysis, and providing real-time insights. Blockchain is bringing unprecedented levels of security and transparency to financial transactions.

Data analytics is transforming the way organizations use financial data, enabling them to make data-driven decisions and gain a competitive edge.

Ending Remarks

As we wrap up our journey through the world of accounting information systems, it’s clear that these systems are essential for the success of any organization. They provide the foundation for accurate financial reporting, informed decision-making, and compliance with regulatory requirements.

By embracing emerging technologies and best practices, businesses can leverage their AIS to gain a competitive edge and drive growth in the years to come.

Q&A

What are the benefits of implementing an AIS?

An effective AIS can improve financial accuracy, streamline operations, enhance decision-making, and reduce the risk of fraud.

What are the different types of AISs?

There are three main types of AISs: manual, computerized, and cloud-based. Each type has its own advantages and disadvantages.

What are the key security measures for an AIS?

AIS security measures include access controls, data encryption, and regular backups. These measures help protect financial data from unauthorized access and cyber threats.